Real World Asset Tokenization - Is a License Needed?

This article aims to offer clarity to Real World Asset (RWA) Tokenization issuers and investors. Given that the majority of RWAs are classified as securities, navigating the intricate web of rules and regulations becomes imperative. The regulatory landscape varies based on the asset type, permissible investors, geographical location, and other factors.

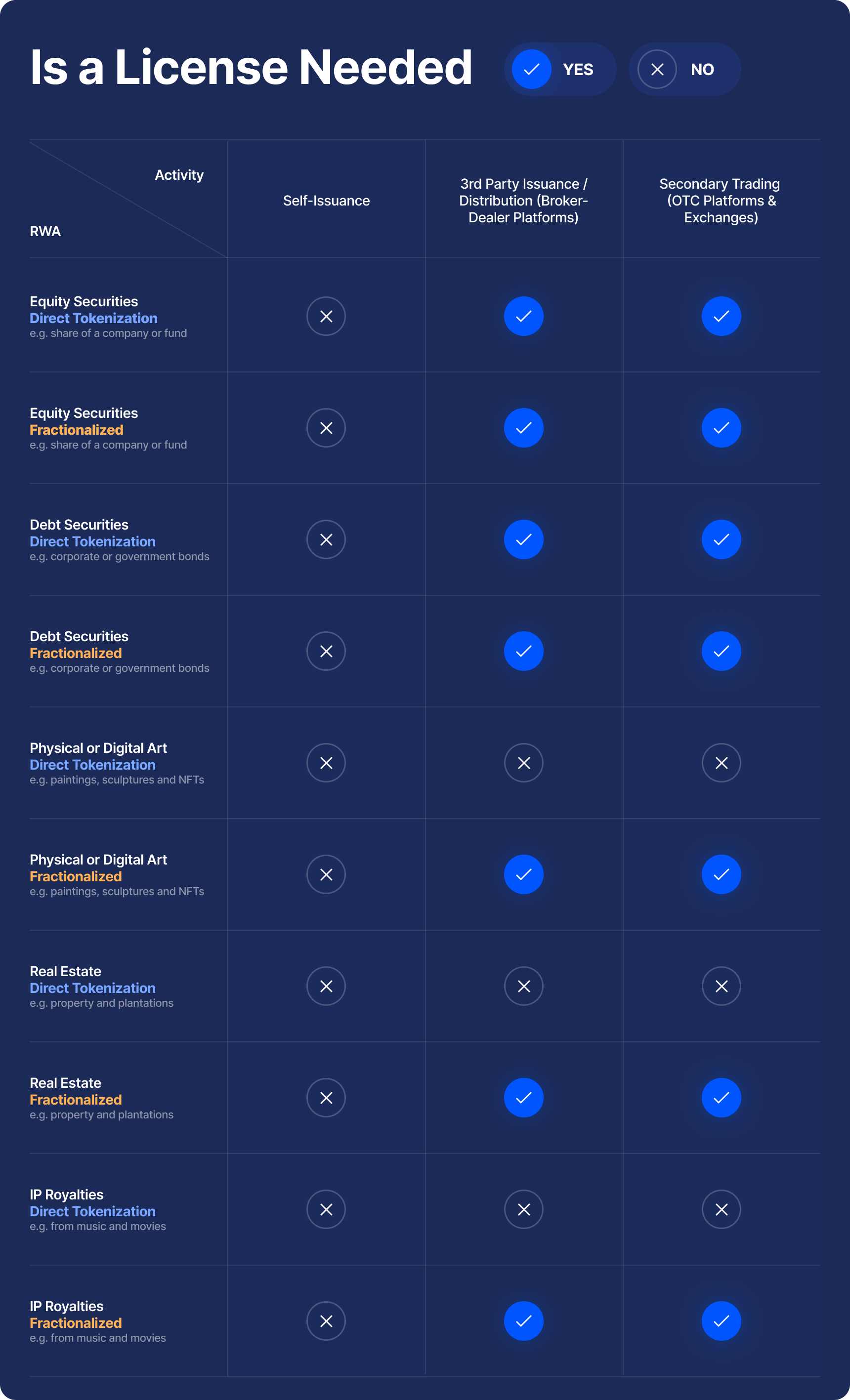

In the sections below, we outline various asset types and the channels through which investors can access them, along with our insights into the associated licensing and regulations. It's crucial to note that Diagram 1.0 below serves as a general overview and guidance, considering the existence of exemptions and loopholes across different asset classes and markets. Therefore, conducting your own research (DYOR) for each asset is recommended.

Drawing upon the wealth of expertise within our legal team, considered among the most seasoned in the industry, particularly for spearheading advancements in the RWA sector in Asia, and bolstered by our expansive network and possession of all requisite licenses to facilitate RWA issuance for global investors, IX Swap and InvestaX's platforms stand as an unparalleled one-stop-shop for all RWA tokenization needs.

Diagram 1.0

Jenny Johnson, the CEO of Franklin Templeton, the $1.5T USD global investment firm, says “Bitcoin is the greatest distraction from the biggest opportunity in finance, tokenized assets”.

Real World Asset Tokenization is now experiencing explosive growth despite the fact it has actually been in development for the past five years and has been “rebranded” several times along the way.

In this thought piece, we break down the short history of the industry and also the necessary licensing requirements required for different types of products and activities related to issuing or investing in RWA products and platforms.

There is still much confusion in the industry due to the existence of many different types of projects, with some operating in violation of regulations. So, it is important to understand what you are doing, what is or isn’t legal, and how to best navigate through the challenges of understanding what is going on, so that you can still capture the value in all these new opportunities.

Here is a brief timeline of some of the key events in the history of the RWA market (which is also called the Security Toke Offering (STO) market) and the digital securities or tokenized securities industry:

2017: One of the first STOs was launched by Blockchain Capital and raised $10M USD in a single day. It was a tokenized venture capital fund share.

2018: The security token market, as it was called that year, grows rapidly with over $1 billion raised. Token issuance-only (technology) companies were the main infrastructure available for issuers wanting to “tokenize” their assets and launch an STO. Open finance also launches as the world’s first STO exchange.

2019: The security token market matures with more regulatory clarity and a growing number of security token platforms. tZero launches as one of the first regulated security token exchanges in the world and USA. InvestaX built its first token issuance platform on top of its broker dealer license. The first security token custodians start to surface.

2020: The security token market continues to grow with over $2 billion raised. The industry is starting to see more infrastructure come to market, including broker-dealers and custodians for security tokens. JP Morgan builds its own token infrastructure platform called ONYX to tokenize public assets, so they can be lent or borrowed, which wasn’t possible in their previous format.

2021: The security token market sees a slowdown due to the COVID-19 pandemic but still raises over $1 billion and infrastructure players continue to grow. Crypto titans Binance, Bitfinex and FTX launch their first STO, albeit improperly, as they were unlicensed and were forced to remove those offerings. At the same time, DBS Bank in Singapore launched a crypto exchange, signaling that the decentralized finance (DeFi) players are coming for the STO industry and the traditional finance (TradFi) players are coming for the crypto industry.

2021: IX Swap launches the world’s first automated market maker (AMM) for security tokens, launching the first legal and compliant liquidity pools for security tokens. This is the killer application solving the liquidity issues in the STO market.

2022: STO market continues to grow with over $1.5 billion raised and more platforms going live. All major financial institutions have launched security token projects and/or are building their own internal capabilities. InvestaX secures one of the first Recognized Market Operators licenses in Singapore for a security token exchange, the first using public protocols.

2023: “Tokenization” momentum is now exploding because infrastructure is now ready for end-to-end issuance. The other major event that happened was due to the DeFi meltdown in 2022/2023, resulting in there being no yields available for crypto investors. So, we witnessed the first tokenized treasury bills paying high yields. This meant the holders of crypto, and specifically stable coins like USDC, started investing into T-bill STOs and the DeFi industry created the acronym “RWA”. Now, we are seeing an explosion of new RWA tokens coming to market, including structured products, money market funds, tokenized derivatives, and more.

So, although TradFi knows “RWA” to mean risk weighted asset, the DeFi industry now uses it to explain security tokens or asset backed tokens as well.

“RWA” or “STO”, whichever term you choose to use doesn’t really matter. What is important is that there is now a seismic shift aiming to catapult tangible assets into the digital realm through the power of blockchain. In a world of digital currencies and other digital assets (like NFTArt), it makes sense to have a world of digital securities or RWA tokens. Now all of this is only possible if you are using public blockchains to issue your RWA tokens, and we talk more about that here “Public vs Private Blockchains”. Let’s now take a look at how it actually works in real life.

How RWA Tokenization Works

The process of RWA tokenization typically involves the following steps:

1. Asset evaluation: The value of the asset is carefully assessed and documented. This is standard finance and investing practice for any asset.

2. Legal structuring: A legal framework is established to ensure that digital tokens represent a valid claim to the underlying RWA and the specific token rights are determined.

3. Custody: The RWA is securely stored and managed by either a company founder, licensed manager, or qualified custodian. There are many different types of assets in the world and how they are handled is widely different.

4. Tokenization: The representation of the ownership of the asset is converted into digital tokens (which we call “RWA tokens”) on a chosen blockchain and launched on either the RWA issuer’s website, or through a tokenization platform that has broker dealer licenses (like InvestaX and IX Swap).

5. Investors must register and pass KYC/AML checks to be able to purchase RWA tokens (for those which are securities). The investors can choose to hold their RWA tokens in their own wallets or through 3rd party licensed custodians.

6. These RWA tokens may then be listed for secondary trading:

● Through RWA licensed broker dealers;

● On RWA licensed exchanges; or

● On IX Swap’s RWA decentralized exchange (called the IXS DEX).

This is another interesting article on RWA Tokenization by Coindesk: “RWA Tokenization, What Does It Mean to Tokenize Real World Assets”.

A Win-Win Scenario

RWA tokenization isn’t just a one-sided affair. It’s a narrative where both RWA owners and investors can benefit.

For RWA Issuers :

● Increased Accessibility: Tokenized RWAs can reach a wider pool of potential investors worldwide.

● Enhanced Liquidity: RWA owners can more easily raise capital by selling tokenized or fractionalized portions of their RWA, without having to dispose of the entire RWA itself.

● Improved Efficiency: Tokenized RWAs can reduce intermediaries, administrative costs and time associated with traditional models.

● No Liquidity Discount. RWA owners can overcome the typical challenge of finding buyers for substantial and costly RWAs, and avoid the need to settle for reduced prices.

For Investors:

● Increased Liquidity: Investors can easily buy, sell, and trade tokenized RWAs 24/7 through digital platforms.

● Fractional ownership: Investors can participate in the ownership of high-value RWAs, even with limited capital.

● Diversification: Tokenized RWAs offer a new asset class for investors to diversify their portfolios.

● Transparency: Blockchain technology provides a transparent record of asset ownership and transactions.

Are all RWA Tokens Securities?

In the RWA tokenization landscape, determining whether a tokenized RWA is treated as security boils down to the asset being tokenized, the token’s structure, and the regulatory definition at play. Different countries employ different criteria for what qualifies as a “security”. Not all RWA are securities.

The predominant structure is where the RWA is placed under the ownership of an entity and the entity is then tokenized and issued through a pooling of funds from multiple investors, giving investors indirect interests in the underlying RWA. These tokens should be regarded as securities.

Another reason why this is a commonly used structure is that most RWA ownership is subject to regulatory registration, posing challenges for RWA token fractionalized ownership and transferability. For instance, land registries typically limit the number of parties permitted to own a piece of land and any ownership changes must be registered. However, a notable development in this space is the Israel Land Authority’s initiative to introduce a digital land registry and a trading exchange for tokenized real estate.

Another type of structure that exists is one where RWAs are tokenized directly but this structure appears to be less common because of issues such as impracticability, non-fungibility, lack of regulatory clarity and limited use cases.

For RWA owners and token issuers, navigating these regulatory and structural intricacies requires a nuanced understanding of both the intended token structure and the various legal definitions applied indifferent countries.

The Licensing Question

Now that we have explained how RWA tokens work and are structured, let’s break down the licensing question since there has been much confusion in the market over if and when licenses are needed for RWA tokenization. Diagram 1.0 above generally illustrates the licensing requirements for primary issuance (self-issuance and 3rd party issuance /distribution) and secondary trading for different types of RWA tokens.

Where an RWA is tokenized directly (for example, through non-fungible tokens (NFTs)) so that ownership of the RWA is represented in digital rather than paper form, that may not be a security (except for equity or debt securities, since they would be securities in both paper and digital forms). But this type of structure fails to harness the full power of blockchain technology since it merely replaces traditional forms of records.

On the other hand, where there is a pooling of funds from, and issuance to, multiple investors (through fractionalization), those tokens will most likely constitute securities. This is the prevailing market structure because it unlocks the secondary trading and liquidity aspects of blockchain as well. Let’s look deeper into the licensing requirements for this structure.

In most jurisdictions, a tokenized RWA owner should be allowed to carry out its own primary issuance of RWA tokens, through self-issuance, without a license. However, most owners cannot typically rely on their own networks alone to garner sufficient interest, and have to engage third parties to tap into their distribution channels. These third parties which help to facilitate the distribution and primary issuance are colloquially known as “broker-dealers” and are required to be licensed in order to carry out these activities.

A key attraction of RWA tokenization is tradability and transferability, which happens post-primary issuance. RWA token investors do not want to be locked in forever and require options for liquidity. This is where secondary trading comes into the picture. Avenues for secondary trading such as over-the-counter (OTC) platforms and multilateral exchanges or marketplaces, where many people can come together to buy, sell, and trade RWA tokens, is pivotal for the entire RWA tokenization industry. But not just anyone can establish and operate a secondary trading venue. These come along with many regulatory requirements, such as licenses, safeguards, trading rules, and the like.

The major roadblock in the RWA tokenization space has been regulatory risk arising from operating without licenses. Applying for licenses is a tedious and costly business. Think drawn out application processes, constant engagement with and scrutiny from regulators, substantial capital requirements, and the cost of employing an entire team to help manage the whole workflow.

Many RWA owners and issuers understandably do not have the resources or the capacity to pursue such licenses. As a result, some of these players have resorted to ride roughshod over the legal requirements, only to find themselves unable to scale, or worse, coming under the watchful eye of regulators. Others have tried to devise clever structures and nomenclature in an attempt to dress their tokenized RWAs as non-securities, but this comes at the expense of expensive legal fees and without any certainty that such untested structures and nomenclature will stand the test of time. Regulators examine substance over form. Call it what you want: “STO”, “RWA” or “NFT”; if it looks and smells like a security, chances are that it is.

The Future is Tokenization With IX Swap and InvestaX

RWA tokenization isn't merely a trend. It’s slated to be the vanguard of a revolution that transforms the investment landscape. As liquidity cascades, fractional ownership blossoms, and transparency illuminates, we stand on the precipice of a new era.

IX Swap and InvestaX are well placed to stand in the gap, with the required licenses and full suite of services for RWA tokenization. Complete with the infrastructure and licenses to operate RWA token broker-dealer platforms and exchanges, IX Swap and InvestaX provide RWA owners and issuers peace of mind, regulatory certainty and a one-stop-shop for all their tokenization needs.

Brace yourselves as RWA tokenization continues to evolve, promising innovative applications and unprecedented opportunities for investors and asset owners alike. The future is here.

Contact us at support@investax.io to kickstart your RWA tokenization journey in a legally compliant manner today!